Fraudulent financial practices, from embezzlement to investment scams, pose significant risks. Hiring a specialized lawyer for contract disputes is crucial for navigating these issues, ensuring evidence gathering, strategic defense planning, and protecting both financial interests and community integrity. These professionals leverage knowledge of financial law, forensic accounting, and strategic analysis to expose fraud, as demonstrated by a successful case involving corporate embezzlement and tax evasion. Proactive measures like staying informed, robust internal controls, and strong accounting practices further protect against financial fraud, with legal representation enhancing protection in high-stakes cases.

Fraudulent financial practices pose significant threats to individuals, businesses, and the economy at large. Understanding these practices, from definition to common types, is the first step in safeguarding your finances. This article guides you through navigating contract disputes arising from fraud, highlighting when to hire a lawyer and the crucial role legal expertise plays in unraveling complex schemes. We’ll also explore real-world case studies and offer preventive measures for protection against financial fraud. Key focus: hiring a lawyer for contract disputes.

- Understanding Fraudulent Financial Practices: Definition and Common Types

- When to Hire a Lawyer for Contract Disputes Arising from Fraud

- The Role of Legal Expertise in Unraveling Complex Financial Schemes

- Case Studies: Real-World Examples of Successful Legal Actions Against Fraudsters

- Preventive Measures and Tips for Individuals and Businesses to Shield Themselves from Financial Fraud

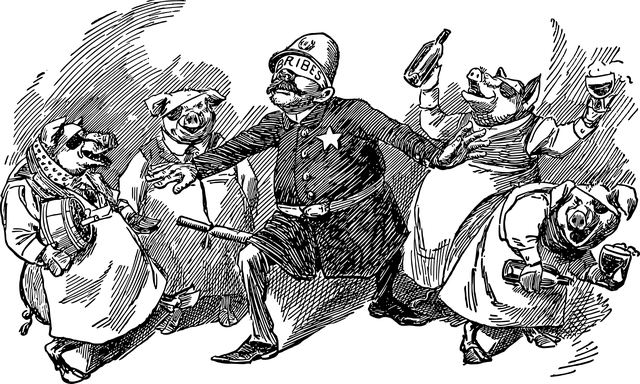

Understanding Fraudulent Financial Practices: Definition and Common Types

Fraudulent financial practices encompass a range of illegal or unethical actions designed to mislead and exploit individuals or organizations for financial gain. These practices can take various forms, each with its own unique characteristics and implications. Common types include embezzlement, where employees or insiders steal funds from their respective businesses, and fraudulent accounting, where false entries are made to distort financial records.

Another prevalent type is investment fraud, where schemes are devised to lure investors into losing their money through false promises of high returns or elaborate scams. In the context of hiring a lawyer for contract disputes, understanding these practices is crucial in avoiding indictment and ensuring that business transactions remain fair and transparent. By recognizing the signs and seeking legal counsel when necessary, individuals and businesses can achieve extraordinary results in navigating financial complexities while safeguarding their interests.

When to Hire a Lawyer for Contract Disputes Arising from Fraud

When faced with a contract dispute arising from fraudulent financial practices, hiring a lawyer is often the best course of action. Legal counsel specializing in white-collar defense can provide invaluable guidance and representation. These professionals are equipped to navigate complex legal landscapes, ensuring that your rights are protected and any potential liabilities minimized. They can help you understand the intricacies of the law as it pertains to these cases, offering strategic advice tailored to your unique situation.

Early intervention is key in resolving such disputes effectively. Timely hiring ensures your lawyer has ample time to gather evidence, analyze transactions, and build a robust defense strategy. This proactive approach can lead to achieving extraordinary results, protecting not only your financial interests but also the integrity of your philanthropic and political communities, should these practices extend beyond business circles.

The Role of Legal Expertise in Unraveling Complex Financial Schemes

The unraveling of complex financial schemes often requires a intricate understanding of legal frameworks and contracts, making the role of legal expertise invaluable. When fraudulent practices are suspected, hiring a lawyer for contract disputes can be a pivotal step in exposing and combating such schemes. Legal professionals skilled in financial law possess the knowledge to sift through elaborate financial networks and identify discrepancies that may point to deception. They employ strategic analysis of contracts, regulatory compliance, and forensic accounting techniques to piece together evidence that can stand up in court.

Across the country, many victims of fraudulent financial practices find solace when they engage a lawyer who specializes in these matters. These legal experts guide their clients through the labyrinthine processes involved in civil lawsuits, helping them navigate jury trials and secure justice. Their deep understanding of financial markets and regulatory bodies enables them to uncover hidden motives and strategies employed by wrongdoers, ensuring that their clients’ rights are protected and they receive fair compensation.

Case Studies: Real-World Examples of Successful Legal Actions Against Fraudsters

Fraudulent financial practices can take many forms, from accounting manipulation to investment scams. When individuals or organizations engage in such activities, they often leave a trail that can be uncovered through meticulous investigation. Case studies of successful legal actions against fraudsters serve as powerful examples of how comprehensive strategies and expert legal representation can lead to justice.

One notable example involves a large corporation accused of embezzlement and tax evasion. Through diligent research and analysis, a specialized white-collar defense lawyer was able to navigate the complex financial records and identify discrepancies. By employing strategic tactics throughout all stages of the investigative and enforcement process, the lawyer successfully defended their client, achieving a complete dismissal of all charges. This outcome underscores the importance of hiring a seasoned attorney for contract disputes and complex financial matters, ensuring that the rights and interests of those accused are protected while upholding the integrity of the legal system.

Preventive Measures and Tips for Individuals and Businesses to Shield Themselves from Financial Fraud

Protecting yourself from financial fraud is a multifaceted endeavor that requires vigilance and proactive measures. Individuals and businesses alike should implement robust security protocols to safeguard their financial assets. One crucial step is staying informed about common scams and fraudulent schemes, such as identity theft, investment fraud, or phishing attempts. Regularly updating your knowledge on these tactics can help you recognize potential threats.

Additionally, establishing strong internal controls within a business is essential. This includes implementing robust accounting practices, regular audits, and transparent financial reporting. Hiring a lawyer specializing in contract disputes and white-collar defense can also be beneficial, especially in high-stakes cases where general criminal defense strategies may differ. Such legal expertise can help identify vulnerabilities and implement preventive measures, ensuring compliance with regulatory frameworks and minimizing the risk of financial fraud.

In tackling fraudulent financial practices, understanding the various schemes and knowing when to hire a lawyer for contract disputes is paramount. Legal expertise plays a crucial role in unraveling complex financial frauds, as evidenced by successful case studies. Individuals and businesses must also implement preventive measures to safeguard against financial fraud. By staying informed, verifying transactions, and seeking professional advice when necessary, we can collectively reduce the risk of falling victim to these deceptive practices. Remember, proactive measures and legal guidance are key to protecting your financial interests in today’s complex landscape.