Early detection of fraudulent financial practices and adhering to copyright laws are essential for businesses to prevent losses, legal repercussions, and reputational damage. Monitoring red flags like unusual transactions, discrepancies, conflicts of interest, unauthorized access, and intellectual property rights issues is crucial. Implementing strong internal controls, thorough background checks, secure data storage, proper licensing, regular audits, and community engagement can protect against fraud and copyright infringement in high-stakes sectors. Legal professionals specialize in guiding businesses through copyright law complexities to avoid significant penalties and maintain integrity.

Fraudulent financial practices pose significant risks to businesses, leading to substantial losses and legal complications. This article explores critical aspects of recognizing red flags that indicate potential fraud, such as unusual financial transactions and inconsistencies in accounting records. We delve into the legal implications of copyright infringement within financial crimes and offer best practices for safeguarding your business from fraudulent activities, emphasizing strategies to avoid copyright infringement in daily operations.

- Recognizing Red Flags: Common Fraud Indicators

- Legal Implications: Copyright and Financial Crimes

- Best Practices: Safeguarding Your Business from Fraud

Recognizing Red Flags: Common Fraud Indicators

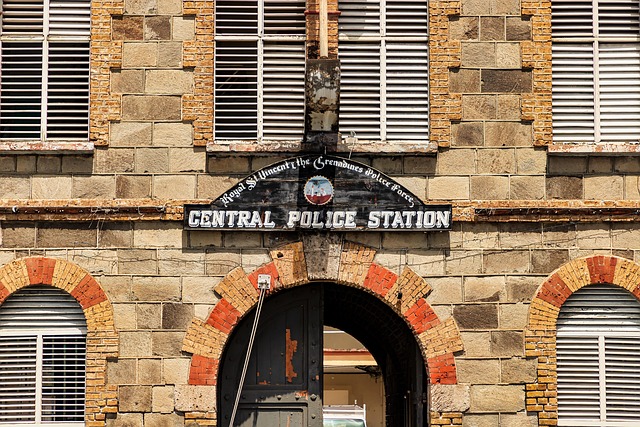

Recognizing fraudulent financial practices early is a key step in avoiding significant losses and legal repercussions. Businesses should be vigilant about certain red flags that often indicate dishonest behavior. These include unusual or unexplained transactions, discrepancies in accounting records, and potential conflicts of interest. For instance, if an employee suddenly spends large sums from the company account on personal items, it warrants immediate scrutiny. Similarly, any unauthorized access to financial systems or suspicious activity related to intellectual property rights, such as copyright infringement, should be treated with caution. By keeping a close eye on these indicators, businesses can implement measures to protect their assets and ensure compliance.

Avoiding copyright infringement in business operations is another critical aspect of maintaining integrity. This involves understanding the respective legal frameworks and taking proactive steps to safeguard original content. While some signs of fraud may be obvious, others require a deeper investigation. If there’s a general criminal defense strategy in place, it can help in addressing any charges with complete dismissal as a potential outcome. Staying informed about common fraud indicators enables businesses to stay one step ahead and foster an environment where ethical practices thrive.

Legal Implications: Copyright and Financial Crimes

In the realm of financial crimes, avoiding copyright infringement is a critical aspect for businesses to navigate legally. Copyright laws protect original works of authorship, including financial models, algorithms, and proprietary data used in business operations. Unauthorized use or reproduction of such intellectual property can lead to severe legal consequences, such as civil lawsuits and criminal charges. Businesses must ensure they have the necessary permissions and licenses to use copyrighted materials, adhering to fair use guidelines where applicable.

For his clients involved in high-stakes cases, understanding copyright law is essential to mitigate risks during jury trials. Fraudulent practices that involve copyright infringement can result in substantial financial penalties, reputational damage, and even imprisonment. Legal professionals specializing in this area play a crucial role in guiding businesses on strategies to avoid copyright infringements, helping them stay compliant and protect their interests in the competitive business landscape.

Best Practices: Safeguarding Your Business from Fraud

To safeguard your business from fraudulent practices, it’s essential to implement robust internal controls and policies. Start by ensuring rigorous background checks for employees and vendors to prevent individuals with a history of fraud from gaining access. Regularly update and educate staff on anti-fraud measures, recognizing suspicious activities, and reporting concerns through confidential channels. Implement secure data storage and encryption methods to protect sensitive financial information, mitigating the risk of unauthorized access or misuse.

Additionally, stay vigilant against copyright infringement in business operations. This involves obtaining proper licenses for software, media, and intellectual property to avoid legal complications. Regularly audit your digital assets and workflows, ensuring compliance with copyright laws. Engaging with the philanthropic and political communities can also foster awareness about fraud prevention, as these sectors often deal with high-stakes cases that require robust anti-fraud mechanisms.

In conclusion, understanding fraudulent financial practices is paramount for businesses aiming to protect themselves from significant legal repercussions and financial losses. By recognizing common red flags, such as unusual transactions or discrepancies in documentation, individuals can mitigate risks associated with copyright infringement and other financial crimes. Adopting best practices, like enhancing internal controls and conducting thorough background checks, serves as a robust defense against fraud. Moreover, staying informed about evolving legal implications ensures businesses navigate the complex landscape of copyright laws effectively, thus avoiding costly mistakes and preserving their integrity in today’s digital era.