Understanding contract breach patterns is crucial in fighting financial fraud. Common defenses in breach cases rely on due diligence, good faith, and documentation. Data analytics, machine learning, and expert testimony aid in identifying fraudulent activities like money laundering and insurance scams. This proactive approach strengthens defenses, promotes transparency, and aids law enforcement in combating economic crimes by analyzing vast datasets for irregularities. Effective strategies involve meticulous document review, narrative construction, and regulatory adherence, with early fraud detection boosted by ethical conduct, employee education, and regular audits.

In today’s digital age, financial fraud detection has become paramount. This article delves into the intricate world of fraud enforcement, focusing on contract breach patterns, where data analytics plays a pivotal role. We explore legal strategies to combat fraudulent activities and uncover common defenses in breach of contract cases. By understanding these dynamics, businesses can implement preventive measures to mitigate risks effectively. Embrace these insights for a robust fraud detection and prevention strategy.

- Understanding Contract Breach Patterns

- Role of Data Analytics in Detection

- Legal Strategies for Fraud Enforcement

- Preventive Measures: Mitigating Risks

Understanding Contract Breach Patterns

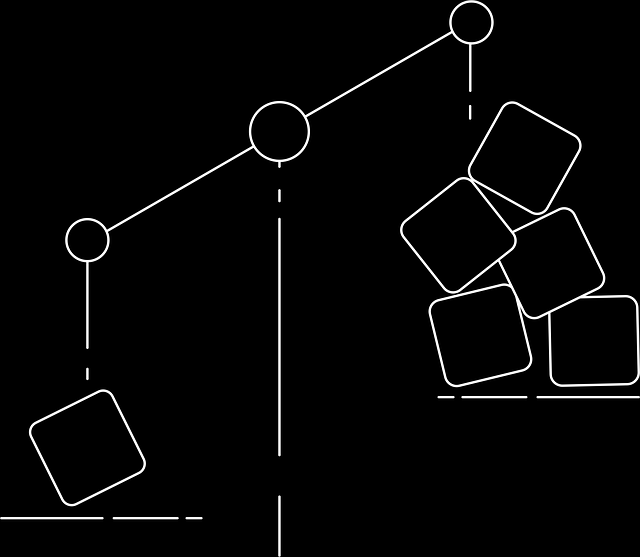

In the realm of financial fraud detection, understanding contract breach patterns is a crucial step in identifying and preventing illicit activities. Breach of contract cases often involve complex financial transactions, making it imperative to analyze recurring themes and deviations from standard practices. By studying these patterns, professionals can establish common defenses that mitigate risks and avoid indictment in legal proceedings. This proactive approach not only helps in safeguarding businesses but also supports the broader efforts of the philanthropic and political communities by fostering transparency and accountability.

Common Defenses in Breach of Contract cases typically center around demonstrating due diligence, good faith, and reasonable reliance on contractual terms. Legal strategists often leverage documentation, communication records, and expert testimony to prove that actions taken were within the bounds of accepted practices. Additionally, establishing a history of successful transactions can serve as a shield against accusations, showcasing a track record of fulfilling contractual obligations. These defenses are especially critical in high-stakes financial fraud cases, where distinguishing legitimate business conduct from malicious intent is paramount, often distinguishing between general criminal defense and specific fraud charges.

Role of Data Analytics in Detection

The role of data analytics in financial fraud detection has become increasingly significant as we navigate through complex economic landscapes. Advanced analytical techniques empower investigators to uncover subtle patterns and anomalies indicative of fraudulent activities, such as money laundering, insurance claims scams, and white-collar crimes. By leveraging machine learning algorithms and sophisticated statistical models, analysts can sift through vast datasets—including financial transactions, customer records, and market trends—to identify suspicious behaviors that might otherwise go unnoticed.

This proactive approach enhances common defenses in breach of contract cases, as data analytics can pinpoint irregularities at all stages of the investigative and enforcement process, across the country. By integrating these tools into fraud detection strategies, law enforcement agencies and financial institutions are better equipped to combat economic crimes, ensuring a more robust and efficient response to potential threats.

Legal Strategies for Fraud Enforcement

In the realm of financial fraud detection, understanding legal strategies for fraud enforcement is paramount. When it comes to breach of contract cases, common defenses often emerge, which can range from good-faith efforts to perform the contract to allegations of unconscionability or lack of intent. These defenses are typically examined closely during jury trials, where the onus lies on both parties to present compelling evidence. The legal landscape for fraud enforcement is intricate, reflecting the diverse nature of financial transactions and the sophisticated methods employed by white-collar criminals.

Philanthropic and political communities often find themselves caught in these legal webs, necessitating a thorough understanding of their rights and obligations. As fraud cases navigate complex legal terrain, effective strategies involve meticulous document review, expert testimony, and persuasive narrative construction. Ultimately, successful enforcement hinges on the ability to demonstrate a clear breach and resulting damages, leaving no room for ambiguous interpretations that might favor the accused, especially in the intricate dance between business agreements and criminal intent.

Preventive Measures: Mitigating Risks

Implementing robust preventive measures is paramount in financial fraud detection, as it serves as a first line of defense against potential risks. Common defenses in breach of contract cases involve a combination of strict adherence to regulatory frameworks and internal controls. Organizations must establish thorough vetting processes for clients and partners, ensuring transparency and compliance from the outset. By adopting advanced data analytics and machine learning algorithms, financial institutions can identify suspicious patterns and anomalies that may indicate fraudulent activities.

Additionally, fostering a culture of ethical conduct within the philanthropic and political communities is essential. Educating employees on risk management practices enables them to recognize red flags and report potential fraud promptly. Regular audits and internal investigations further reinforce these efforts, ensuring that respective businesses maintain integrity and achieve extraordinary results while mitigating risks effectively.

Financial fraud detection is an evolving field that combines advanced data analytics with robust legal strategies. By understanding common breach patterns, leveraging analytical tools to identify anomalies, and implementing preventive measures, institutions can significantly mitigate risks. Additionally, legal strategies focused on stringent enforcement play a crucial role in deterring fraudulent activities. Incorporating these comprehensive approaches—from contract analysis to data-driven insights and legal framework—serves as the foundation for stronger defenses in breach of contract cases, thereby fostering trust and stability in financial transactions.