The RF Securities Industry is regulated by a complex web of legal standards aimed at protecting investors and maintaining market integrity. Central to this framework are the Legal Standards for Burden of Proof, which govern the amount of evidence required in securities cases, impacting both civil liabilities and criminal charges. These standards, enforced by regulators like the SEC or FCA, ensure fairness and prevent baseless claims. As the industry evolves with digital technologies, updating these legal standards to address complex fraud cases and sophisticated defense strategies is crucial for maintaining public trust and effective regulation.

“The RF Securities industry, a cornerstone of global finance, operates under stringent regulations aimed at fostering transparency and protecting investors. This article delves into the intricate world of RF Securities Industry Regulation, offering an in-depth understanding of its key components. From legal standards governing the burden of proof in securities litigation to the roles of regulatory bodies, we explore the dynamic landscape. Furthermore, we analyze contemporary challenges and controversies, providing insights into future trends shaping RF Securities oversight.”

- Understanding RF Securities Industry Regulation: An Overview

- Legal Standards for Burden of Proof in Securities Litigation

- Regulatory Bodies and Their Roles in Enforcing Compliance

- Key Challenges and Controversies in RF Securities Regulation

- Future Trends and the Evolving Landscape of RF Securities Oversight

Understanding RF Securities Industry Regulation: An Overview

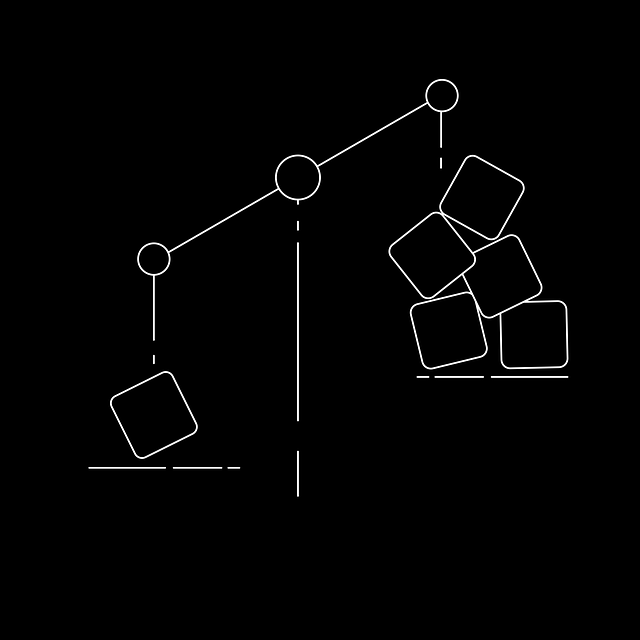

The RF Securities Industry Regulation is a complex web of legal standards designed to ensure fairness, transparency, and integrity within the financial markets. At its core, this regulation aims to protect investors by holding market participants accountable for their actions. Understanding this regulatory framework involves grasping the intricate balance between promoting stable markets and allowing for fair competition. One critical aspect is the Legal Standards for Burden of Proof, which dictate how much evidence is required to prove or disprove allegations in securities-related cases.

These standards play a pivotal role in all stages of the investigative and enforcement process, from initial inquiries to formal proceedings. They impact not just civil liabilities but also criminal charges, shaping strategies for both prosecutors and defendants. A robust understanding of these legal standards is crucial for navigating the general criminal defense, especially when aiming to achieve winning challenging defense verdicts. This knowledge ensures that market players can defend their interests while upholding the integrity of the financial system.

Legal Standards for Burden of Proof in Securities Litigation

In securities litigation, the Legal Standards for Burden of Proof play a pivotal role in determining the outcome of legal disputes. The burden of proof lies with the plaintiff or prosecutor, who must present compelling evidence to establish their case beyond a reasonable doubt. This standard is particularly stringent, especially in financial matters where complex transactions and intricate regulations are involved.

Throughout all stages of the investigative and enforcement process, the onus is on the complainant to prove their allegations against corporate and individual clients alike. This ensures fairness and prevents baseless accusations, allowing regulators and courts to make informed decisions based on substantial evidence. The respective business practices and conduct must be meticulously scrutinized, keeping in mind the Legal Standards for Burden of Proof, to uphold the integrity of the securities market.

Regulatory Bodies and Their Roles in Enforcing Compliance

Regulatory bodies play a pivotal role in the RF Securities industry by enforcing compliance with legal standards and regulations. These organizations are tasked with ensuring that market participants adhere to stringent rules designed to protect investors, maintain fair trading practices, and promote market integrity. Each jurisdiction has its own regulatory authority, such as the SEC (Securities and Exchange Commission) in the United States or the FCA (Financial Conduct Authority) in the UK, which possess the power to investigate, issue penalties, and bring legal action against non-compliant entities.

The burden of proof lies with these regulatory bodies to demonstrate that a violation has occurred. They must meet high legal standards, often requiring unprecedented track records and extensive evidence to substantiate their claims in high-stakes cases. This rigorous process is essential for maintaining public trust and ensuring that market participants behave responsibly, ultimately achieving extraordinary results in terms of fair and transparent financial markets.

Key Challenges and Controversies in RF Securities Regulation

The regulation of RF (radio frequency) securities, while crucial for maintaining market integrity, faces significant challenges due to the complex and evolving nature of financial technologies. One of the primary hurdles is establishing clear legal standards for the burden of proof. In cases involving RF securities fraud, determining liability requires navigating intricate technical details, making it difficult to assign responsibility under existing legal frameworks. This challenge intensifies during all stages of the investigative and enforcement process, from initial suspicion to jury trials, as proving intent and knowledge becomes increasingly complex.

Moreover, the rise of sophisticated white-collar defense strategies further complicates matters. Accused parties often employ technical experts to challenge the validity of evidence, introducing nuances that can blur the lines of accountability. Consequently, regulators are tasked with updating legal standards to keep pace with technological advancements while ensuring fairness and accuracy in RF securities regulation. This delicate balance is essential to maintaining public trust and effectively combating fraud in this dynamic financial landscape.

Future Trends and the Evolving Landscape of RF Securities Oversight

The RF Securities Industry is on the cusp of significant transformation as regulatory bodies adapt to the ever-evolving digital financial landscape. Future trends indicate a heightened focus on enhancing transparency and accountability in high-stakes cases, with regulators playing a more active role in oversight. This shift promises to bring about stricter legal standards for burden of proof, ensuring that all parties involved are held accountable for their actions.

As the regulatory environment becomes more complex, so too does the need for robust legal strategies. The industry’s ability to navigate these changes will be crucial in achieving extraordinary results and winning challenging defense verdicts. Those who stay ahead of these trends and adapt their practices will be better positioned to thrive in this dynamic and ever-changing regulatory landscape.

The regulation of the RF securities industry is a complex web that involves understanding legal standards, such as the burden of proof in securities litigation, and navigating the roles of various regulatory bodies. As the landscape continues to evolve, addressing key challenges and controversies will be essential for maintaining integrity and stability within the market. By staying informed about future trends, professionals in this sector can adapt and ensure compliance with the ever-changing regulatory framework, fostering a robust and trustworthy financial environment.