In the dynamic securities industry, navigating complex regulatory compliance is vital to mitigate litigation challenges. Proactive measures like training, internal controls, and ethical culture are crucial for avoiding fines and indictment due to non-compliance. Effective strategies involve robust record-keeping, transparent communication, and staying ahead of evolving regulations to protect against white-collar crimes and foster sustainable growth.

“The RF Securities industry faces a complex regulatory landscape, demanding adherence to stringent rules to mitigate financial risks. This article guides you through the intricate web of regulations, focusing on three key aspects: navigating the regulatory maze, understanding and defending against litigation challenges in securities, and implementing effective compliance strategies. By delving into these areas, investors and professionals can ensure robust risk management, fostering a resilient and transparent financial environment.”

- Navigating Complex Regulatory Landscape

- Unraveling Litigation Risks in Securities

- Compliance Strategies: Defending Against Challenges

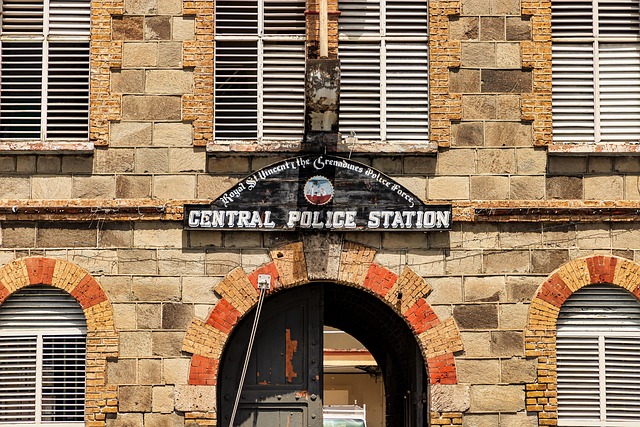

Navigating Complex Regulatory Landscape

The RF Securities Industry faces a complex regulatory landscape, filled with intricate rules and guidelines designed to protect investors. Financial institutions must navigate this labyrinthine environment, ensuring strict compliance to avoid litigation challenges that can result in significant fines or even indictment. The ever-changing nature of regulations demands constant vigilance and adaptation from industry players.

One critical aspect of navigating this landscape is understanding the potential consequences of non-compliance. While achieving a complete dismissal of all charges for his clients is an ideal goal, it’s essential to focus on proactive measures. These include regular training programs, robust internal controls, and a culture that prioritizes ethical conduct. By embracing these strategies, financial institutions can minimize regulatory risks and protect themselves from litigation in the long run.

Unraveling Litigation Risks in Securities

The securities industry is a high-stakes arena where companies and investors navigate complex financial landscapes. Unraveling litigation risks in this sector is paramount as even minor missteps can lead to significant legal repercussions. Financial regulatory compliance involves navigating a web of rules and regulations designed to protect investors, ensuring fair markets, and maintaining stability. However, the dynamic nature of these regulations presents unique challenges. Companies must stay agile and proactive to avoid potential pitfalls that could trigger costly litigation challenges in financial regulatory compliance.

Across the country, cases involving securities fraud have led to substantial jury trials, underscoring the importance of robust internal controls and transparency. General criminal defense strategies are often employed to mitigate these risks, focusing on due diligence, accurate record-keeping, and transparent communication. By proactively addressing potential litigation risks, companies can not only safeguard their reputation but also ensure sustainable growth in an increasingly regulated environment.

Compliance Strategies: Defending Against Challenges

In the dynamic landscape of financial markets, Regulatory Compliance is no longer a mere check-box exercise but a robust defense mechanism against mounting litigation challenges. RF Securities Industry Regulation requires institutions to adapt their strategies, especially in addressing the intricate web of white-collar and economic crimes that have become increasingly sophisticated. An unprecedented track record of regulatory enforcement underscores the heightened scrutiny on businesses, necessitating proactive measures to ensure adherence across all sectors.

Compliance officers play a pivotal role in forging these defenses by implementing robust systems and procedures designed to mitigate risks. This involves regular audits, employee training programs, and transparent reporting mechanisms that foster a culture of accountability. By staying ahead of regulatory trends and adapting their strategies accordingly, financial institutions can fortify their defenses against legal repercussions, thereby safeguarding their respective businesses from the far-reaching consequences of non-compliance.

In navigating the complex regulatory landscape of the securities industry, understanding and mitigating litigation risks are paramount. By unraveling potential legal pitfalls and implementing robust compliance strategies, financial institutions can defend against challenges effectively. Through proactive measures and staying abreast of regulatory changes, the industry can foster a more secure and stable environment for all participants, ensuring fair practices and protecting investors from Litigation Challenges in Financial Regulatory Compliance.