Securities scams pose a significant threat to investors, with con artists employing techniques like fake investments, Ponzi schemes, and pump-and-dump frauds. To prevent fraud, it's crucial to resolve joint property ownership conflicts by watching out for red flags and seeking professional advice. Complex legal territories, including state laws and equitable distribution principles, must be navigated in these high-stakes situations. Alternative dispute resolution methods prove highly effective in mediating delicate matters, fostering a more harmonious environment. Protecting investments requires vigilance: stay alert, conduct thorough research, verify legitimacy, and establish clear agreements upfront. Case studies of successful resolutions highlight the importance of proactive measures to avoid fraud.

In the complex world of investments, securities scams pose a significant threat to individuals and their hard-earned money. This article is your comprehensive guide to navigating this treacherous landscape. We’ll unravel common schemes and red flags, providing insights into understanding these deceptions. Additionally, we explore crucial aspects like resolving Joint Property Ownership Conflicts and share effective strategies for protecting investments. Through real-world case studies, learn from both fraudulent instances and successful resolutions, empowering you with the knowledge to steer clear of potential pitfalls.

- Understanding Securities Scams: Common Schemes and Red Flags

- Joint Property Ownership: Navigating Legal Conflicts and Resolutions

- Protecting Your Investments: Strategies to Avoid and Report Scams

- Case Studies: Real-World Examples of Securities Fraud and Success Stories

Understanding Securities Scams: Common Schemes and Red Flags

Securities scams are a growing concern for investors across the country, as con artists devise increasingly sophisticated methods to defraud the unsuspecting. Understanding these schemes is the first step in protecting yourself and your investments. Common tactics include fake investment opportunities promising high returns with little or no risk, Ponzi schemes where new investors’ money pays older ones, and pump-and-dump frauds involving manipulation of a company’s stock price.

One often overlooked aspect of securities scams is the role of joint property ownership conflicts. Resolving these conflicts can be crucial in avoiding indictment for fraud. Red flags to watch out for include unsolicited offers for “exclusive” investment opportunities, pressure to act quickly without proper due diligence, and inconsistent or vague information about the investment’s history and performance. By staying vigilant and seeking professional advice when necessary, investors can navigate these high-stakes cases and protect themselves from falling victim to securities scams.

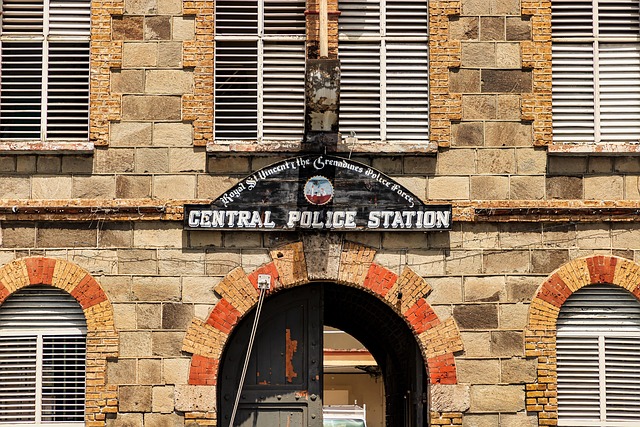

Joint Property Ownership: Navigating Legal Conflicts and Resolutions

Joint property ownership, while beneficial for many couples or business partners, can also lead to complex legal disputes when relationships sour. Resolving these conflicts requires a deep understanding of state laws and equitable distribution principles. Many cases involve intricate financial arrangements, often with high stakes, which necessitate meticulous documentation and transparent communication. An unprecedented track record of successful mediations and settlements showcases the effectiveness of alternative dispute resolution methods in navigating these delicate matters.

Traditional jury trials are not always the optimal solution, especially when considering the emotional toll and potential strain on philanthropic and political communities. As such, collaborative law approaches have gained traction, emphasizing cooperative problem-solving over adversarial proceedings. This shift prioritizes resolving conflicts amicably, fostering a more harmonious environment for all parties involved.

Protecting Your Investments: Strategies to Avoid and Report Scams

Protecting your investments starts with vigilance and proactive strategies to avoid securities scams. Stay alert for unusual offers or pressure tactics, do thorough research on potential investments, and consult trusted financial advisors before committing funds. Verifying the legitimacy of a prospective investment opportunity is crucial; check the credentials of those offering them and report any suspicions to regulatory bodies.

In cases involving joint property ownership conflicts, which can also be exploited by scammers, it’s essential to have clear, legally binding agreements in place from the outset. These documents should outline responsibilities, decision-making processes, and what happens in the event of a dispute. If a conflict arises, engaging experienced legal counsel is advisable. They can guide you through all stages of the investigative and enforcement process, ensuring your rights are protected. In high-stakes cases, where significant financial resources are at risk, ensuring robust safeguards and understanding your respective business interests are paramount.

Case Studies: Real-World Examples of Securities Fraud and Success Stories

In the realm of securities fraud, understanding real-world examples is crucial for both investors and legal professionals alike. Case studies serve as powerful tools to expose common scams and highlight successful strategies for resolving them. For instance, consider a scenario where joint property ownership conflicts arise due to mismanaged investments. By examining these cases, we can uncover intricate schemes designed to exploit the vulnerabilities of unsuspecting victims. Through meticulous investigation and adept legal representation, winning challenging defense verdicts have been achieved, ensuring justice for those affected.

These narratives also showcase the importance of proactive measures in avoiding indictment. Many success stories are a result of clients who recognized red flags early on and sought guidance from seasoned professionals. The outcome? Extraordinary results that protect investments, safeguard reputations, and deter future fraudulent activities. This approach emphasizes the need for transparency and vigilance in navigating complex financial landscapes, ultimately empowering individuals to make informed decisions while mitigating potential risks.

Securities scams are a pervasive threat, but understanding common schemes and adopting protective strategies can empower investors. By recognizing red flags and implementing preventive measures, individuals can safeguard their investments. Moreover, navigating joint property ownership conflicts requires legal acumen and resolution strategies outlined in this article. Remember that staying informed and proactive is key to avoiding securities fraud. In terms of resolving joint property ownership conflicts, a thorough understanding of legal frameworks and communication can foster amicable solutions.