Understanding consumer protection laws is crucial for businesses and consumers, ensuring fair practices and legal redress. Federal and state legislation target misleading claims, price gouging, and unfair contracts. In white-collar crime cases, mitigating penalties involves challenging evidence admissibility, showcasing positive societal contributions, and admitting guilt early. Consumers can aid this process by reporting violations and providing relevant documents. Legal experts interpret these records to strengthen cases, connect them to laws, and present compelling narratives. Post-trial strategies, including appeals and restitution, significantly influence outcomes, aiming for balanced punishment and reparation.

Consumer protection suits are a critical aspect of ensuring fair business practices. This comprehensive guide explores the intricacies of consumer protection laws, with a focus on white-collar crimes and their unique legal challenges. We delve into strategies to mitigate penalties for accused individuals, emphasizing the role of evidence and legal experts in building robust defenses. Understanding post-trial scenarios, including sentencing, appeals, and restitution options, is key to navigating these complex cases effectively.

- Understanding Consumer Protection Laws: A Foundation for Suits

- White-Collar Crimes: Unique Challenges and Legal Implications

- Strategies to Mitigate Penalties: Key Defenses for Accused Individuals

- The Role of Evidence and Legal Experts in Building a Strong Case

- Post-Trial Scenarios: Sentencing, Appeals, and Restitution Options

Understanding Consumer Protection Laws: A Foundation for Suits

Understanding Consumer Protection Laws forms the bedrock upon which consumer protection suits are built. These laws are designed to safeguard consumers from unfair, deceptive, or fraudulent practices in various transactions. By establishing clear guidelines and regulations, they empower individuals to assert their rights and seek legal redress when violated. For instance, federal and state legislation often prohibit companies from making misleading claims, engaging in price gouging, or imposing unfair contracts on consumers.

Knowing these laws is crucial for both businesses and consumers alike. Businesses must navigate these regulations to mitigate penalties in white-collar crime cases, ensuring compliance to avoid winning challenging defense verdicts or, worse, a complete dismissal of all charges. Consumers, armed with this knowledge, can better recognize and report instances of consumer protection violations, ultimately contributing to a more transparent and just marketplace while potentially avoiding indictment for participating in legally protected actions.

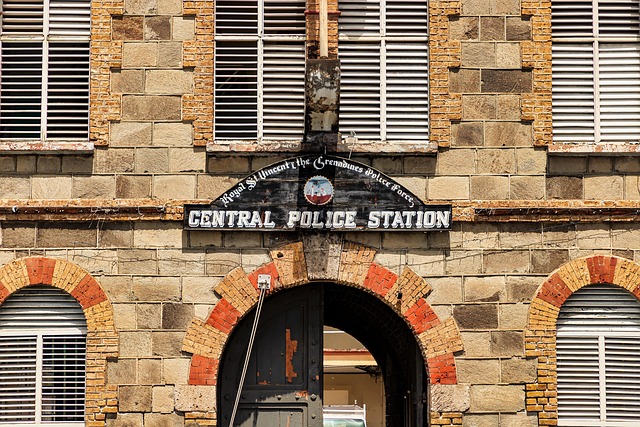

White-Collar Crimes: Unique Challenges and Legal Implications

White-collar crimes, encompassing fraud, embezzlement, and other financial misdeeds, present unique challenges for both legal professionals and those accused. These crimes often involve complex financial transactions, intricate documentation, and sophisticated schemes, making them notoriously difficult to detect and prove. Unlike street crimes, white-collar offenses typically occur behind closed doors, in boardrooms and corporate offices, leaving a trail of paperwork rather than physical evidence. This creates a significant hurdle for investigators, who must sift through vast amounts of data to identify patterns and establish intent.

The legal implications of these crimes are profound. Mitigating penalties in white-collar crime cases often involves demonstrating a lack of malicious intent or minimizing the extent of damage. Defendants may argue that their actions were not criminally intentional but rather the result of negligence or poor judgment. Additionally, the involvement of philanthropic and political communities can further complicate matters, as these entities may have unique expectations regarding corporate governance and ethical conduct. Navigating all stages of the investigative and enforcement process, from initial inquiries to trials, requires a deep understanding of financial laws and their intricate legal interpretations.

Strategies to Mitigate Penalties: Key Defenses for Accused Individuals

In mitigating penalties in white-collar crime cases, accused individuals and their legal representatives employ a range of strategies to avoid harsh sentences. One key defense is challenging the admissibility of evidence, particularly digital and financial records, which may have been obtained through unlawful means or improperly handled by law enforcement. Another effective approach involves presenting character witnesses and demonstrating the client’s positive contributions to society, especially in cases involving corporate and individual clients across the country.

Additionally, accused parties can argue for leniency by highlighting their cooperation with authorities, including providing substantial assistance in investigations or admitting guilt early on. This cooperativeness often results in reduced charges or sentences, as it avoids indictment and shows a willingness to take responsibility for actions. Furthermore, legal teams may focus on mitigating circumstances, such as minimal involvement or the absence of prior criminal history, to convince judges to impose lesser penalties.

The Role of Evidence and Legal Experts in Building a Strong Case

In consumer protection suits, evidence and legal expertise are pivotal in crafting a compelling case. Gathering detailed records of transactions, communications, and documentation related to the alleged misconduct is essential. This includes receipts, contracts, emails, and any digital footprint that can substantiate the claims. Legal experts play a crucial role in interpreting these pieces of evidence, connecting them to relevant laws, and presenting them in a way that maximizes their impact. Their strategic insights can significantly mitigate penalties for businesses facing white-collar crime charges.

Beyond internal documentation, expert witnesses and industry professionals can provide valuable testimony, sharing insights into standard practices across the country. This helps establish whether certain business actions are considered acceptable or violate consumer protection laws. For his clients, these legal strategists ensure that the narrative is not just about the facts but also about how those facts reflect adherence to or deviation from respected business standards.

Post-Trial Scenarios: Sentencing, Appeals, and Restitution Options

Post-trial scenarios play a pivotal role in shaping the outcomes of consumer protection suits, particularly when mitigating penalties in white-collar crime cases. If a defendant is found guilty, sentencing becomes a critical phase where judges consider factors like the severity of the offense, prior criminal history (if any), and the accused’s remorse or lack thereof. The goal for defense teams in such cases is often to avoid indictment and secure a complete dismissal of all charges through compelling legal arguments and presenting winning challenging defense verdicts.

Appeals are another common post-trial avenue, allowing both parties to challenge the verdict or sentence. This process requires meticulous attention to detail and a robust legal strategy. Restitution options also come into play here; besides prison time or fines, judges can order defendants to compensate victims directly, ensuring that the interests of those harmed by the white-collar crime are considered.

Consumer protection suits are complex legal battles that demand a deep understanding of both consumer rights and criminal law. By navigating the intricacies of consumer protection laws, defending against white-collar crimes, and employing effective strategies to mitigate penalties, individuals can protect themselves from severe consequences. Leveraging robust evidence and legal expertise is crucial for building a compelling case. Ultimately, successful navigation through post-trial scenarios, including sentencing, appeals, and restitution options, ensures justice while minimizing the impact of these significant legal matters.