Securities Class Actions are investor-led lawsuits against companies or officers for securities misconduct, requiring a deep understanding of class action litigation and legal expertise. The Right to Counsel in Criminal Cases extends to these actions, enabling investors to access specialized attorneys who navigate complex financial and legal issues. By leveraging this right, investors can pool resources, present compelling evidence, and argue robustly to seek compensation for harm caused by fraudulent practices, ultimately promoting fairness and transparency in the market. Strategic representation is crucial, involving industry expertise, meticulous preparation, and tailored legal arguments, leading to successful outcomes that may even result in the complete dismissal of charges.

Securities class actions are a powerful mechanism protecting investors from fraudulent or negligent conduct. This article delves into this legal landscape, focusing on three key aspects. First, we explore the fundamental concept from a legal perspective. Second, we analyze the crucial role of the Right to Counsel, drawing parallels with its application in criminal cases. Lastly, we discuss strategies for effective representation navigating the complexities of these lawsuits. Understanding these dynamics is essential for investors and legal professionals alike.

- Understanding Securities Class Actions: A Legal Perspective

- The Role of Right to Counsel in Protecting Investors

- Navigating the Complexities: Strategies for Effective Representation

Understanding Securities Class Actions: A Legal Perspective

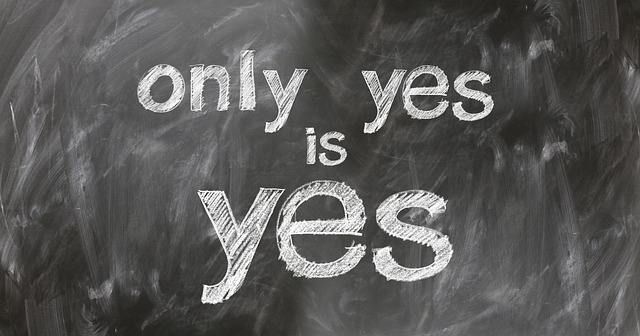

Securities Class Actions involve a group of investors bringing a lawsuit against a company or its officers for misconduct related to securities. From a legal perspective, understanding these actions requires grasping the principles of class action litigation and the unique rights afforded to plaintiffs in such cases. One significant aspect is the Right to Counsel in Criminal Cases, which parallels the right of individuals involved in securities disputes to seek legal representation. This right ensures that investors have access to expert advice and protection throughout the legal process, enabling them to navigate complex financial and legal issues.

In these actions, investors can band together, sharing resources and knowledge while pursuing collective compensation for harm caused by fraudulent or misleading practices. While general criminal defense strategies may not directly apply, the principles of jury trials and winning challenging defense verdicts are essential. Effective representation in securities class actions often hinges on presenting compelling evidence, constructing robust legal arguments, and ultimately securing favorable outcomes for the affected investors.

The Role of Right to Counsel in Protecting Investors

The Right to Counsel is a fundamental principle in legal systems, and its application extends beyond criminal cases. In the context of securities class actions, this right plays a pivotal role in protecting investors’ interests. When investors face complex legal battles against powerful corporations, having access to competent legal representation can make all the difference. The Right to Counsel ensures that investors are not left to navigate intricate financial matters and legal jargon alone.

In these cases, experienced attorneys specializing in securities law can provide invaluable guidance, ensuring their clients’ rights are upheld. By exercising their right to counsel, investors gain a powerful ally who can help them achieve extraordinary results for their respective businesses or personal financial interests. This legal support is crucial in holding accountable those who have engaged in fraudulent activities or violated securities regulations, ultimately fostering fairness and transparency in the market.

Navigating the Complexities: Strategies for Effective Representation

Navigating the complexities of securities class actions requires a strategic approach to ensure effective representation for plaintiffs. These cases often involve intricate legal and factual issues, making it crucial for lawyers to possess deep industry knowledge and experience. A successful strategy should focus on thoroughly understanding the specifics of the case, including the underlying violations, market impact, and potential remedies available under various securities laws.

By employing a comprehensive approach, attorneys can achieve remarkable outcomes. An unprecedented track record in these cases often stems from meticulous case preparation, leveraging expert witnesses, and crafting compelling legal arguments. Moreover, maintaining open lines of communication with clients and staying abreast of relevant regulatory changes are essential. The right to counsel in criminal cases extends to securities matters, ensuring that individuals have access to legal representation tailored to their unique needs. This not only safeguards their rights but also fosters transparency and accountability within the philanthropic and political communities. Ultimately, a well-executed strategy can lead to complete dismissal of all charges, demonstrating the power of diligent advocacy.

Securities class actions play a crucial role in protecting investors and ensuring fair market practices. By understanding the legal complexities involved, especially through the lens of the Right to Counsel, attorneys can effectively represent their clients. Navigating these intricacies requires strategic approaches, as highlighted in this article, to deliver justice and restore trust in financial markets. This comprehensive guide underscores the importance of robust legal representation in safeguarding investor rights.