Mail wire fraud, a digital age crime using electronic communication to deceive individuals and organizations into transferring funds or sensitive information, is primarily targeted under the Federal Sentencing Guidelines for Drug Offenses. These guidelines, crucial for legal professionals, provide a structured framework for sentencing based on loss amount, sophistication, and planning. Evolving techniques include manipulated emails, fraudulent websites, and fake check scams. Convictions carry significant repercussions, including substantial fines and imprisonment, as outlined in the guidelines. Protecting against these frauds demands strengthened security measures, cybersecurity investments, vigilance against unsolicited requests, and proactive transaction scrutiny.

Mail wire fraud, a sophisticated and increasingly prevalent crime, involves manipulating electronic fund transfers through deceptive means. This article offers a comprehensive overview of understanding mail wire fraud, delving into key aspects such as the Federal Sentencing Guidelines for Drug Offenses, common schemes, legal consequences, and preventive measures. By exploring these elements, individuals and businesses can better shield themselves against such scams.

- Understanding Mail Wire Fraud: A Comprehensive Overview

- The Federal Sentencing Guidelines for Drug Offenses: Key Provisions

- Common Schemes and Techniques Used in Mail Wire Frauds

- Legal Consequences and Penalties for Convicted Offenders

- Preventive Measures and Best Practices to Shield Against Such Scams

Understanding Mail Wire Fraud: A Comprehensive Overview

Mail wire fraud is a sophisticated and prevalent crime that has evolved with the digital age. It involves the deceptive use of electronic communication to trick individuals or organizations into transferring funds or sensitive information. This fraudulent scheme often mimics legitimate business transactions, leveraging a deep understanding of respective industries and their processes. By impersonating trusted entities, perpetrators gain access to financial accounts, steal personal data, or divert funds for their illicit gains.

The Federal Sentencing Guidelines for Drug Offenses, while primarily focused on drug-related crimes, also provide a framework for prosecuting mail wire fraud. These guidelines emphasize the severity of such offenses, considering factors like the amount of loss, the use of sophisticated means, and the level of planning involved. With an unprecedented track record of achieving extraordinary results in fraud cases, law enforcement agencies have been actively pursuing these criminals, ensuring that they face substantial penalties for their actions.

The Federal Sentencing Guidelines for Drug Offenses: Key Provisions

The Federal Sentencing Guidelines for Drug Offenses play a pivotal role in determining sentences for individuals convicted of drug-related crimes. These guidelines are comprehensive and consider various factors, including the type and quantity of drugs involved, the defendant’s criminal history, and their role in the offense. The key provisions offer a framework that helps ensure consistency and fairness in sentencing, making them crucial for both prosecutors and defense attorneys.

In high-stakes cases involving drug offenses, understanding these guidelines is essential for crafting winning challenging defense verdicts. They provide a range of sentences, allowing judges to individualize punishments while adhering to national standards. This tailored approach ensures that justice is served without being overly punitive, especially in cases where mitigating circumstances exist.

Common Schemes and Techniques Used in Mail Wire Frauds

Mail wire frauds have become increasingly sophisticated, leveraging technology to dupe individuals and businesses alike. Common schemes often involve impersonation, where criminals pose as trusted entities like banks or government agencies. They use manipulated emails or fraudulent websites to trick victims into disclosing sensitive financial information, such as account details and login credentials. Another tactic is the use of fake check scams, where fraudsters send clients a seemingly legitimate check for more than the agreed-upon amount, instructing them to wire transfer the excess funds to a third party—a classic example of a white collar defense scenario.

Techniques may also include diverting funds from legitimate business transactions. Criminals create false invoices or alter existing ones, convincing corporate and individual clients to initiate wire transfers to compromised accounts. These scams often target businesses with weak internal controls or those dealing in substantial financial volumes. The Federal Sentencing Guidelines for Drug Offenses, while primarily focused on drug-related crimes, provide insights into sentencing for white-collar offenses, emphasizing the need for proportional punishment based on the severity of the fraud and its impact on victims. For his clients facing such charges, a robust defense strategy should involve understanding these common schemes and employing proactive measures to mitigate risks in their business practices.

Legal Consequences and Penalties for Convicted Offenders

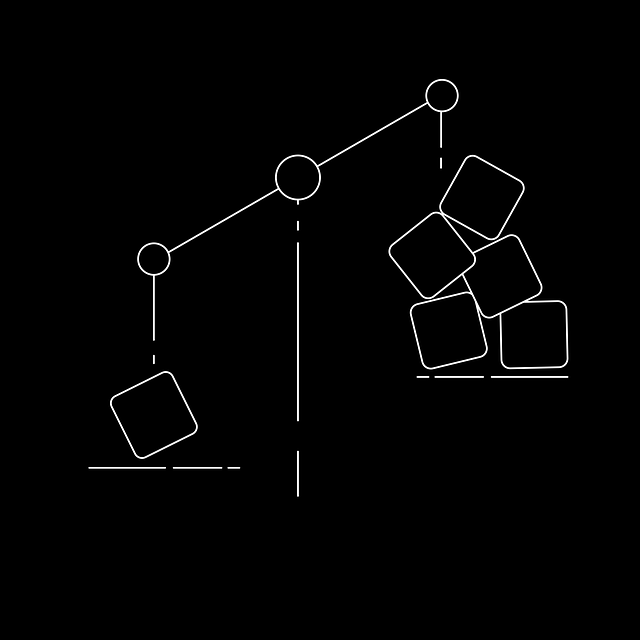

The legal consequences for those convicted of mail wire fraud can be severe, often resulting in substantial fines and imprisonment according to the Federal Sentencing Guidelines for Drug Offenses. The guidelines consider factors like the level of damage caused, the duration of the scheme, and any aggravating or mitigating circumstances. Convicted offenders face a spectrum of penalties, with sentences tailored to the specific case’s impact and the individual’s role within it. In high-stakes cases involving white collar and economic crimes, the stakes are even higher, with potential jail terms extending to years and monetary losses stretching into millions.

A conviction for mail wire fraud can lead to a combination of civil and criminal penalties. Fines may be imposed based on the financial gains or losses associated with the fraudulent scheme. Additionally, individuals found guilty could serve prison time, with sentences determined by federal judges under the guidance of the sentencing guidelines. A robust white collar defense strategy is crucial for navigating these complex legal proceedings, ensuring that rights are protected and fair outcomes are pursued.

Preventive Measures and Best Practices to Shield Against Such Scams

Protecting yourself from mail wire frauds requires a multi-layered approach. First and foremost, it’s crucial to maintain robust security measures when handling sensitive financial transactions. Use secure passwords and two-factor authentication for all accounts, especially those involving money transfers. Additionally, be cautious of unsolicited emails or phone calls requesting personal information or financial details. Always verify the legitimacy of such requests by contacting the organization directly through official channels.

For businesses dealing with high-stakes cases, implementing advanced cybersecurity systems is essential. This includes regular software updates, encryption for data storage, and employee training on phishing scams and social engineering tactics. Moreover, staying informed about the latest fraud trends and best practices, as outlined in the Federal Sentencing Guidelines for Drug Offenses, can serve as a winning challenging defense strategy against such schemes. A general criminal defense approach should involve a proactive stance where every transaction is scrutinized and unusual activities are promptly reported.

Mail wire fraud, a sophisticated and pervasive crime, demands a multi-faceted approach to prevention and prosecution. Understanding the intricate schemes employed and the legal framework, such as the Federal Sentencing Guidelines for Drug Offenses, is paramount in combating this digital age menace. By adopting robust security measures, staying informed about common techniques, and collaborating with law enforcement, individuals and businesses can better protect themselves from these insidious scams. The consequences of conviction are severe, emphasizing the importance of proactive measures to safeguard our financial systems.